Imagine this scenario: you pull up to a gas station and realize your car needs fuel. You see the sign that says gas is $3 per gallon, and you pump 18.12 gallons to fill up. The total cost comes to $54.36. Simple enough, right? You pay for what you use.

Unfortunately, this basic principle doesn't apply in the event industry, particularly when it comes to your outsourced labor costs. There are often surprises at the end of invoices and a lack of transparency around bill rates.

Here are 4 common bill rate misconceptions:

#1: A low bill rate will result in a lower invoice from my labor provider.

#2: The reconciliation process has no impact on your invoice.

#4: Your labor partner's stance on compliance has no effect on your cost.

Misconception #1: A low bill rate will result in a lower invoice.

When outsourcing labor to a partner, it is challenging to find an invoice that accurately bills for what the crew actually worked.

Let's consider a scenario where you have a five-day job and require 20 techs. You are being charged $40 per hour for straight time and $60 per hour for overtime, which equates to $1 per minute if they're in overtime.

To make it easy, let's say the job ends each day at 7:12 PM. The labor company will charge you until either 7:30 PM or most often until 8:00 PM, and you need to check which one they are using.

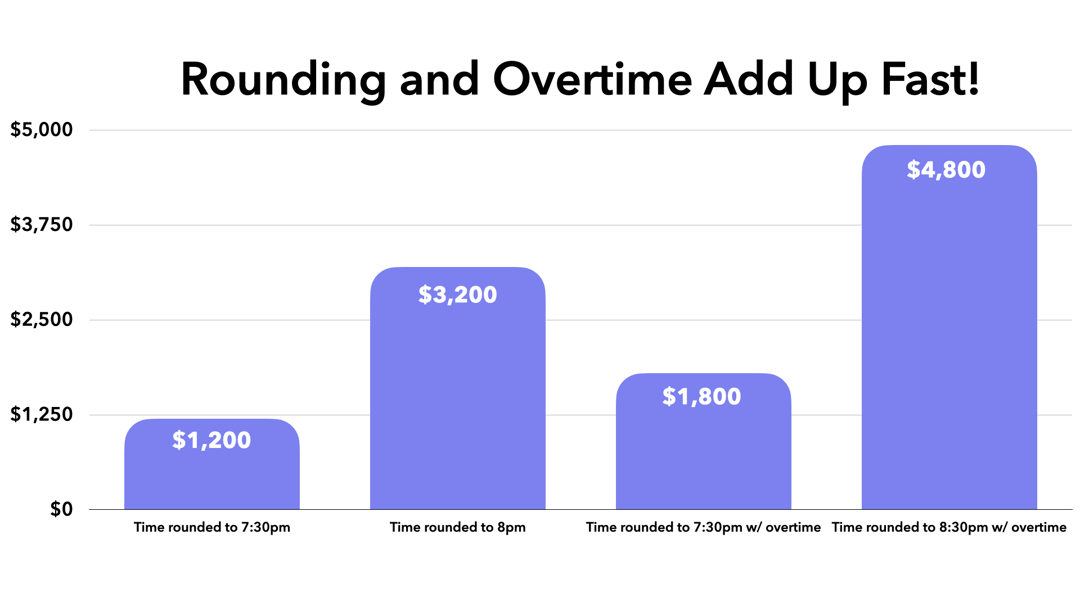

If you are being charged until 7:30 PM, then you will be paying an additional 18 minutes for each of the 20 workers, which amounts to $1,200 for five days of work. This means you are paying for time that was not worked, and you receive no benefit from this extra time. If the company is also charging daily overtime and the workers have already worked more than 10 hours that day, you will pay an additional $1,800 for time that wasn't worked because the job ended at 7:12 PM.

Now let's say the company rounds up to the next hour, which is a common practice. So, if the job ended at 7:12 PM and they round up to 8:00 PM, then you will pay over $3,200 for those five days of work. Additionally, if the workers are being paid overtime, you will overpay by almost $5,000, specifically $4,800.

It's important to understand how you're being billed, since it's not always straightforward. In some cases, a lower bill rate can actually lead to a higher invoice, as seen in the example above. Unless you are too tracking the crew's time, and then comparing it to the agreed-upon terms, you are probably overpaying for services.

Check out the full episode: Don't be Fooled by Low Rates: 4 Billing Misconceptions Debunked

Misconception #2: The reconciliation process has no impact on your invoice.

I strongly recommend you audit your invoice compared to your estimate. Here’s a scenario to explain why.

Let’s say a company requests 13 people to work the load in and load out at an event. Now, fast forward to the moment when you receive a bill that shows 17 people actually worked (four more than you requested). Your first assumption may be that you requested more people to get the job done, so you pay for it and move on.

What likely happened is that the labor company overbooked the crew to cover for any no-shows that could occur. This is a good thing. It shows that they are a reliable partner who wants to ensure you are covered.

However, if all 17 people show up, you end up paying for the extra four people that you didn't actually request.

This is where the reconciliation process comes in, and it can significantly impact your invoice. It is crucial to carefully review and audit your invoice, comparing it to your estimate to ensure accuracy and avoid paying for unnecessary labor costs.

Misconception: #3 Billing rules are not significant in determining the cost of an invoice.

It's important to look beyond just the bill rate and compare the billing policies of different companies. For instance, do both companies charge daily overtime, or does one charge only for weekly overtime? This can have significant effects on your bill.

Additionally, it's important to consider rounding policies. Do both companies round up to the nearest half hour, or does only one company do this? It's possible that the crew worked for a fraction of an hour, so understanding the exact billing policies can help avoid overpaying. This is especially important in states like California and Colorado, where daily overtime requirements differ.

Misconception #4: Your labor partner's stance on compliance has no effect on your cost.

Some companies believe that they can outsource their liability when it comes to worker's comp claims, wage claims, and misclassification by relying on their partner's compliance with regulations, such as providing W-2 crew or 1099's. However, cutting corners in this area can come back to haunt you.

For example, if someone gets hurt on the job, workers' comp will not just go after your labor partner — they will also penalize you, and your client. This means that companies that still use 1099 workers are running out of time.

Yes, your client will end up paying more for compliant talent. But that is how you both stay protected. In fact, some service agreements now require only W-2 crew on the show site.

The truth is, misclassification is a big deal, and it's not going away. When you hire a labor agency, make sure you ask for — and get in writing — that they're sending fully insured W-2 crew, not just fully insured 1099 workers.

The consequences of misclassifying your workers are severe. So, it's crucial to protect yourself, your company, and your client by making sure your labor agency is issuing W-2s.

Understanding your final invoice

There are several factors that can affect how much you pay for talent, besides just the bill rate. That's why it's important to take time to investigate billing rules and how the final invoice compares to what you were expecting.

Some partners are transparent and make everything easy for you. They can even help you get great people while still keeping your bill low. It's totally possible to have both! But just remember, you usually get what you pay for. If you go with a really low bill rate, you might not get the best talent because they're probably getting paid less. The stakes are high in live events. So, if you want amazing people — which lead to an amazing event — you have to be willing to pay for them.

🎧 Check out this Corralling the Chaos episode: